How to Avoid Racking Up Massive Student Loan Debt for College

If the ever-increasing price of college education in this country has broken your spirit and left you with nothing but sarcasm and despair, you’re not alone; tuition rates are climbing so high that the prospect of paying for college can seem terrifying. But taking out a student loan (and racking up massive debt) isn’t the only answer; whether you’re attending a state school or an expensive private university, you should definitely consider the options below.

State Schools

Obviously, going to college in-state is cheaper than going to college out of state, but both can be affordable if you’re willing to take some extra steps. In-state schools will fork out the money to keep you around so long as you impress them, so work hard and earn decent scores on your standardized tests, and you’ll be able to find a good school that might be willing to offer a substantial scholarship.

Folks who live in states like California, Michigan, Texas, and Virginia have the advantage of easy access to excellent public universities, but just about every state can get you to where you want to go in your career without costing you an insane amount of money. At most public universities, in-state or out-of-state, an above-average standardized test score can save you money and give you plenty of career options after graduation. Do your best to ace those big exams now, and you’ll probably be able to avoid crazy student loan debt in the future.

Private Schools

Private schools, by definition, are not primarily funded by taxpayer dollars, so they rely on “donors”—AKA millionaires who eat lobster for dinner on a random Tuesday. These are the kinds of people you want in your corner, and private universities have them on deck.

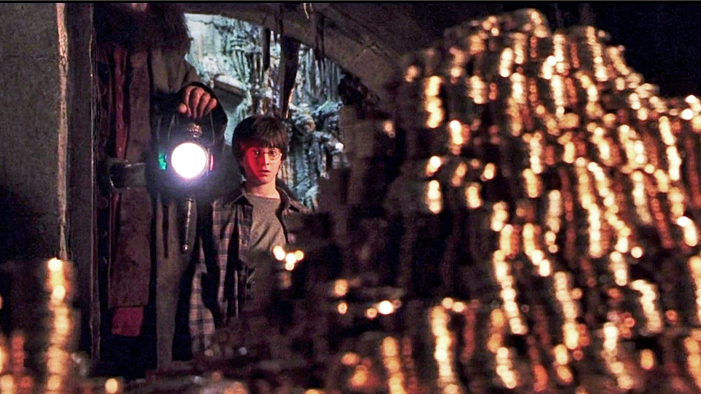

If you glean anything from this post, remember this: money is always out there (kinda). Americans want to invest in their future—that’s why scholarships are everywhere (though admittedly, searching for them might give you Deathly Hallows-horcrux-quest flashbacks). If you can’t afford to attend a private school even after they give you $20,000 per year in grants, start looking locally. Speak to your guidance counselor about opportunities, or reach out to the admissions department at the school of your choice and ask about different scholarships you can apply for. It might take a few (dozen) essay contests and a constant feeling of low-key frustration, but with $1,000 and $2,500 and $5,000 at a time, you can slowly tack on enough money to manage your bills. Then, take a job on campus (the government offers Financial Work Study positions to people whose families genuinely can’t afford it), and you’ll find yourself making ends meet.

Would your life be easier if your grandpa had a dormitory named after him at Bucknell? Of course. But, if you’re willing to put in a heck-ton of hours and live this scenario many times over, your financial situation after college won’t be as bleak as you might think (and if it is, there’s always this as a backup plan. We’re kidding. Mostly).